Does My Heat Pump Qualify For Tax Credit

Imagine this: a frigid winter night, and your home feels…lukewarm. Or perhaps it's a sweltering summer afternoon, and your heat pump is blowing tepid air, not the refreshing chill you crave. One of the most frustrating problems homeowners face is a heat pump that's not heating or cooling effectively. Before you resign yourself to discomfort and a hefty repair bill, let's explore how to troubleshoot the issue and, most importantly, understand if your potential fix qualifies you for a valuable tax credit.

Understanding Heat Pump Tax Credits

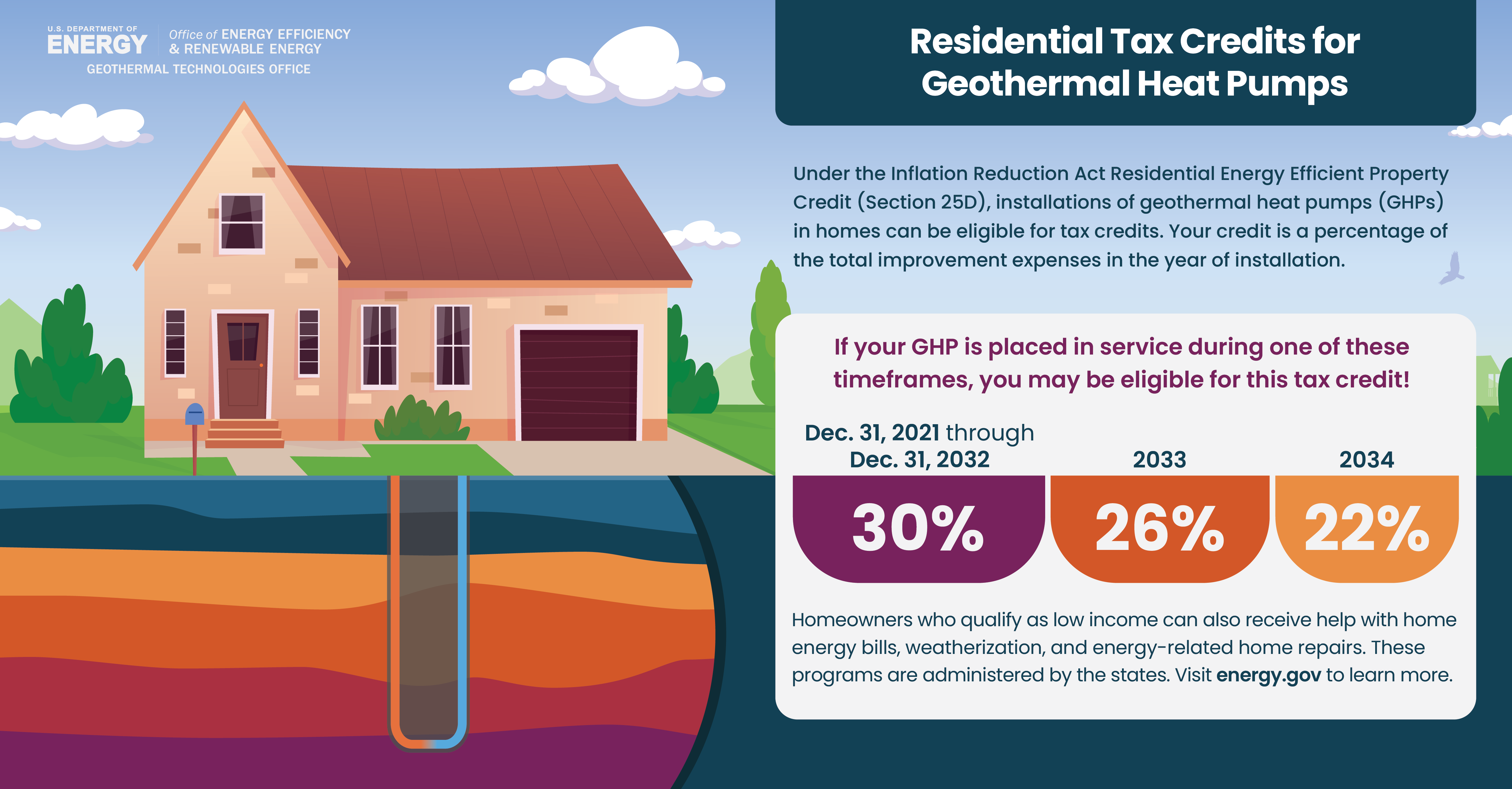

Before diving into troubleshooting, it's crucial to understand why we're discussing tax credits in the first place. Recent government initiatives, like the Inflation Reduction Act, offer significant tax credits for energy-efficient home upgrades, including heat pumps. These credits can substantially reduce the upfront cost of installing or repairing a qualified heat pump. However, not all repairs or installations qualify. Understanding the eligibility criteria is essential. Broadly speaking, these tax credits are associated with:

- New, High-Efficiency Heat Pump Installations: Replacing an old, inefficient system with a new, energy-star rated heat pump often qualifies.

- Significant Upgrades: In some cases, certain upgrades to existing heat pumps that improve their energy efficiency may also qualify.

Key considerations for claiming a tax credit typically include:

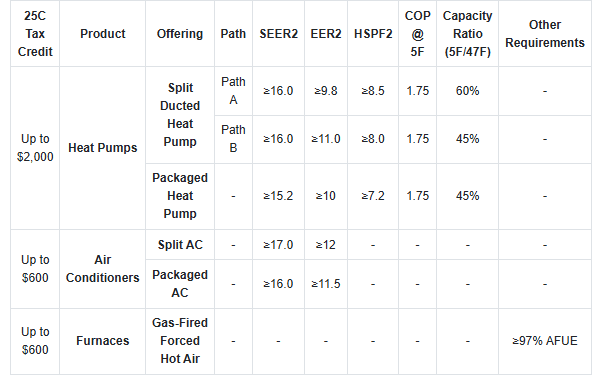

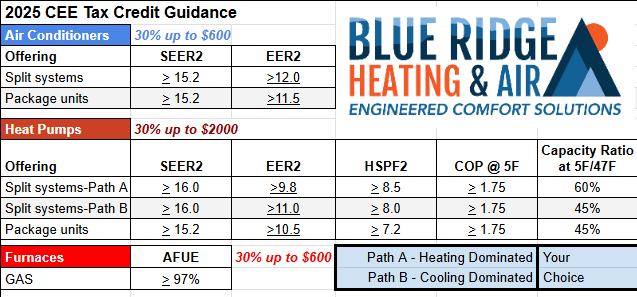

- Efficiency Standards: The heat pump must meet specific SEER (Seasonal Energy Efficiency Ratio) and HSPF (Heating Season Performance Factor) ratings.

- Professional Installation: The installation usually needs to be performed by a qualified professional.

- Proper Documentation: Keep records of purchase receipts, installation invoices, and the heat pump's specifications to support your claim.

Now, let's get to the troubleshooting. The goal is to identify the problem and determine if the required fix might qualify for a tax credit. Remember, safety first! If at any point you feel uncomfortable or unsure, call a qualified HVAC technician.

Troubleshooting: Is Your Heat Pump Underperforming?

We'll follow a step-by-step approach, starting with the simplest checks and progressing to more involved diagnostics.

Step 1: The Quick Visual Inspection (No Tools Required)

This is the easiest step and can often reveal obvious issues.

- Check the Thermostat: Is it set to "Heat" or "Cool" and at the correct temperature? Sounds obvious, but it's a common mistake! Make sure the batteries are good if it's a digital thermostat.

- Air Filter: This is the #1 culprit for heat pump problems. A clogged air filter restricts airflow, making the system work harder and less efficiently. Inspect the filter. If it's dirty, replace it immediately. This alone can solve many issues. Note the filter size before removing it to ensure you buy the correct replacement.

- Outdoor Unit: Visually inspect the outdoor unit (the condenser). Is it free of debris like leaves, snow, ice, or overgrown vegetation? Clear away any obstructions that could be blocking airflow. Ensure there's at least 2-3 feet of clear space around the unit.

- Indoor Vents: Check that all vents in your home are open and unobstructed. Closed vents can disrupt airflow and cause the system to work harder.

Does This Qualify for a Tax Credit? Replacing an air filter almost certainly *won't* qualify for a tax credit. Clearing debris around the unit also won't qualify.

Step 2: More Detailed Checks (Minimal Tools Needed)

If the visual inspection didn't reveal the problem, these steps require a few basic tools.

- Circuit Breaker: Locate the circuit breaker for your heat pump in your electrical panel. Ensure the breaker is switched "On." If it's tripped, reset it. If it trips again immediately, there's likely a more serious electrical problem that requires a professional.

- Condenser Fan: With the system running (set to heat or cool, depending on the season), observe the outdoor unit's fan. Is it spinning? If not, and you're comfortable using a long stick (for safety) to gently nudge the fan blades, try giving them a slight push. If the fan starts spinning after the nudge, the motor may be failing and needs replacement. Important: Never put your hands directly near the fan blades.

- Ice Buildup: In winter, inspect the outdoor unit for excessive ice buildup. A thin layer of frost is normal, but thick ice indicates a defrosting problem. If you see excessive ice, try turning off the heat pump and running only the fan to help melt the ice. After the ice melts, turn the heat pump back on and observe if it's defrosting properly.

Does This Qualify for a Tax Credit? Replacing a failing condenser fan motor *might* qualify for a partial tax credit if it's a high-efficiency motor upgrade that substantially improves the overall efficiency of the system. However, this is a grey area and depends on the specific motor and applicable regulations. Check with a qualified HVAC technician and consult the relevant tax guidelines. Addressing a defrosting problem might involve replacing a defrost timer or sensor. This *might* also qualify for a partial credit under similar circumstances as a fan motor replacement, but it's highly dependent on the specifics.

Step 3: Evaluating Airflow (Simple Tests)

Proper airflow is crucial for heat pump performance.

- Feel the Air at Vents: With the system running, place your hand near the supply vents in each room. Is the airflow strong? Is the air temperature appropriate (warm in winter, cool in summer)? Weak airflow or incorrect air temperature indicates a potential issue.

- Check for Blocked Ducts: Inspect visible ductwork for any obvious kinks, damage, or disconnections. Seal any minor leaks with duct tape. Major ductwork problems require professional attention.

Does This Qualify for a Tax Credit? Sealing minor duct leaks with duct tape almost certainly *won't* qualify for a tax credit. However, a *major* ductwork overhaul or replacement to improve energy efficiency *might* qualify, especially if it's part of a larger energy-efficiency upgrade project. Consult with a qualified HVAC technician and review the specific tax credit requirements.

Step 4: When to Call a Professional (Safety First!)

The following issues are best left to the professionals:

- Refrigerant Leaks: You suspect a refrigerant leak if you hear a hissing sound coming from the unit or see oily residue near connections. Refrigerant is harmful and should only be handled by a certified technician.

- Electrical Problems: Repeatedly tripping circuit breakers, burning smells, or exposed wires are serious electrical hazards. Immediately turn off the system at the breaker and call an electrician or HVAC technician.

- Compressor Issues: The compressor is the heart of the heat pump. If it's making strange noises, failing to start, or overheating, it's likely a major problem requiring professional diagnosis and repair.

- Complex Defrost Problems: If the heat pump continues to ice up excessively even after you've tried troubleshooting, there could be a problem with the defrost control board, reversing valve, or other components.

- Lack of Expertise: If you've tried the troubleshooting steps above and are still unsure of the problem, it's time to call in a professional.

Does This Qualify for a Tax Credit? Repairing a refrigerant leak *might* qualify for a partial tax credit if it involves upgrading to a more environmentally friendly refrigerant and/or making other efficiency improvements. Replacing a compressor is a significant repair and *could* potentially qualify for a partial credit if it's a high-efficiency compressor that demonstrably improves the system's overall energy efficiency. However, this is highly dependent on the specific compressor and applicable regulations. Again, consulting a qualified HVAC technician and reviewing the tax guidelines is crucial. In many cases, replacing the entire heat pump system is more cost-effective and likely to qualify for a larger tax credit than repairing a major component like the compressor.

Determining Tax Credit Eligibility: The Final Steps

Even if you suspect a repair might qualify for a tax credit, don't assume anything. Here's how to confirm eligibility:

- Consult a Qualified HVAC Technician: Get a professional diagnosis and a written estimate for the repair or replacement. Ask them to specifically address whether the proposed fix qualifies for any tax credits or rebates.

- Review the Relevant Tax Guidelines: The IRS website and your state's energy office website provide detailed information on eligible upgrades and the specific requirements for claiming tax credits. Pay close attention to SEER and HSPF rating requirements.

- Keep Detailed Records: Save all receipts, invoices, and product specifications. You'll need these documents to support your tax credit claim.

- Consult a Tax Professional: A tax professional can provide personalized advice and help you navigate the complexities of energy-efficiency tax credits.

Important Note: Tax laws and regulations can change. Always refer to the most up-to-date information from official sources.

Final Thoughts

Troubleshooting a heat pump issue can seem daunting, but by following these steps, you can often identify the problem and take appropriate action. Remember to prioritize safety and call a professional when needed. And don't forget to explore potential tax credits – they can make energy-efficient home improvements more affordable and help you save money in the long run. Good luck!