Financing Air Conditioning Units Bad Credit

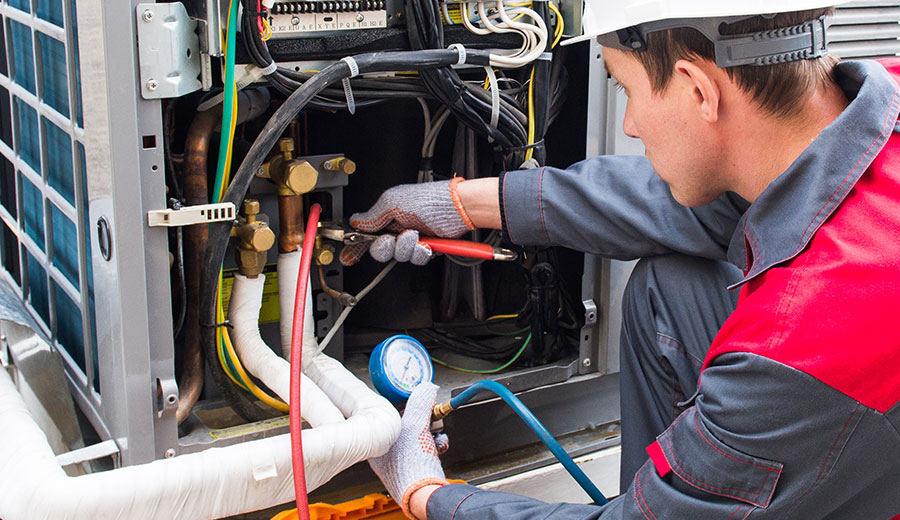

Keeping your home or business comfortable during scorching summers or frigid winters is essential, but it often comes at a steep price. A significant portion of your energy bill likely goes towards heating and cooling. Upgrading to an energy-efficient HVAC system can dramatically reduce these costs, but the upfront investment can be daunting, especially if you have less-than-perfect credit. Fortunately, financing options exist, even for those with bad credit. This article will explore how to finance air conditioning units, even with a less-than-ideal credit score, while highlighting the long-term energy savings and other benefits of investing in a modern, efficient system.

Understanding the Challenges: HVAC Financing and Bad Credit

Securing financing for a new air conditioning unit with bad credit can be challenging. Traditional lenders, such as banks and credit unions, often have strict credit score requirements. A low credit score signals higher risk to lenders, leading to higher interest rates, stringent repayment terms, or even outright rejection. Common credit score ranges and their typical impact on loan approval include:

- Excellent (750+): Typically qualifies for the best interest rates and terms.

- Good (700-749): Generally approved for financing with favorable terms.

- Fair (650-699): May qualify, but with higher interest rates and stricter requirements.

- Poor (Under 650): Difficult to obtain financing from traditional lenders; alternative options are necessary.

Despite these challenges, it's crucial to remember that improving your home's energy efficiency offers long-term financial advantages. An inefficient HVAC system can waste significant energy. According to the Energy Star program, replacing an old air conditioner with a certified model can reduce cooling costs by 20-40%. This means that even with a higher interest rate on a loan due to bad credit, the energy savings can eventually offset the increased borrowing costs.

Exploring Financing Options for Bad Credit

While traditional financing might be difficult, several alternative options cater to individuals with less-than-perfect credit. These options often come with different terms and conditions, so careful research and comparison are essential.

1. HVAC Contractor Financing

Many HVAC contractors offer in-house financing options. These programs might be more flexible than traditional bank loans, particularly for customers with bad credit. Contractors often partner with finance companies that specialize in lending to individuals with lower credit scores. The advantage is convenience – you can apply for financing directly through the contractor while getting a quote for the HVAC system. Be sure to compare the Annual Percentage Rate (APR) and repayment terms with other options. Ask about any prepayment penalties or hidden fees.

2. Personal Loans for Bad Credit

Numerous online lenders specialize in personal loans for individuals with bad credit. These loans typically have higher interest rates and fees compared to traditional loans, but they can provide access to the necessary funds for a new HVAC system. Research lenders carefully, read reviews, and compare terms before committing. Look for reputable lenders with transparent terms and no hidden fees.

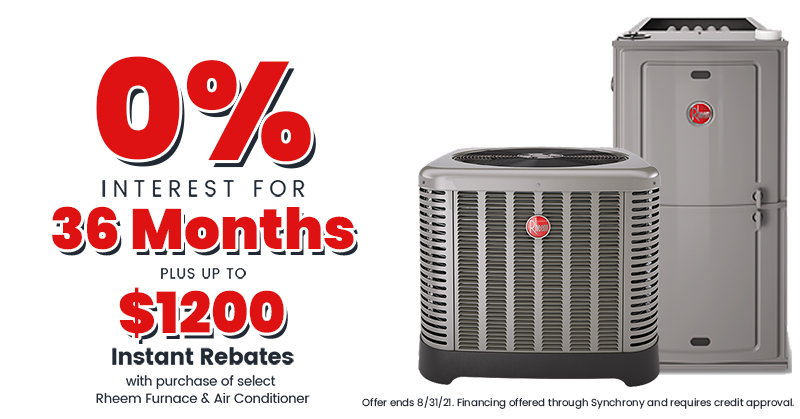

3. Credit Cards with Promotional Financing

Some credit cards offer 0% introductory APR periods on purchases. If you can qualify for a card with a sufficient credit limit, you can charge the HVAC system to the card and pay it off within the promotional period. This can be a cost-effective option, but it requires careful budgeting and timely payments. Missing a payment or not paying off the balance before the promotional period ends can result in high-interest charges. Consider cards specifically designed for home improvement projects, as these often have longer promotional periods.

4. Government and Utility Rebates and Incentives

While not a direct financing option, rebates and incentives can significantly reduce the overall cost of a new HVAC system. Both federal and state governments, as well as local utility companies, often offer rebates for installing energy-efficient appliances, including air conditioners and heat pumps. The Energy Star website is a valuable resource for finding available rebates and incentives in your area. These rebates can help offset the upfront cost, making financing more manageable.

5. Secured Loans

If you own a home, you might consider a secured loan, such as a home equity loan or a home equity line of credit (HELOC). These loans use your home as collateral, which can make it easier to qualify, even with bad credit. However, failing to repay the loan can result in foreclosure, so it's crucial to carefully assess your ability to repay before taking out a secured loan.

6. Lease-to-Own Options

Some companies offer lease-to-own programs for HVAC systems. These programs allow you to use the equipment while making monthly payments. After a set period, you have the option to purchase the system. While these options might seem appealing, they often come with high-interest rates and fees, making them a more expensive option in the long run. Carefully review the terms and conditions before signing a lease-to-own agreement.

The ROI of Energy-Efficient HVAC Systems

Investing in an energy-efficient HVAC system offers numerous long-term benefits beyond simply keeping your home comfortable. Here's a look at the return on investment (ROI):

- Reduced Energy Bills: Energy-efficient systems use less energy to heat and cool your home, resulting in lower monthly utility bills. Energy Star certified models can reduce energy consumption by up to 40%.

- Increased Home Value: Upgrading to a modern, energy-efficient HVAC system can increase your home's value. Buyers are increasingly interested in energy-efficient homes, and a new system can be a significant selling point.

- Improved Indoor Air Quality: Modern HVAC systems often include advanced filtration systems that remove dust, pollen, and other allergens from the air, improving indoor air quality and reducing allergy symptoms.

- Enhanced Comfort: Energy-efficient systems provide more consistent and even heating and cooling throughout your home, eliminating hot and cold spots.

- Environmental Benefits: By reducing energy consumption, you're also reducing your carbon footprint and contributing to a more sustainable environment.

Consider a scenario: An old, inefficient air conditioner with a Seasonal Energy Efficiency Ratio (SEER) of 8 is replaced with a new Energy Star certified model with a SEER of 16. In a climate with long, hot summers, this upgrade could result in significant annual energy savings. Assuming an average cooling cost of $1,000 per year, the new system could save you $300-$400 annually. Over the lifespan of the system (10-15 years), these savings can add up to thousands of dollars, offsetting the initial cost of the upgrade, even when financing with bad credit.

Smart HVAC Integration: Maximizing Energy Savings

Integrating your new HVAC system with smart home technology can further enhance energy efficiency and reduce costs. Smart thermostats, sensors, and automation systems allow you to precisely control your home's temperature and optimize energy usage.

- Smart Thermostats: Learn your schedule and automatically adjust the temperature to save energy when you're away from home. They can also be controlled remotely via a smartphone app.

- Smart Sensors: Detect occupancy and adjust the temperature accordingly. They can also monitor room-by-room temperature variations and adjust airflow to optimize comfort.

- Zoned Heating and Cooling: Allows you to control the temperature in different areas of your home independently, reducing energy waste in unused rooms.

Data point: Studies have shown that smart thermostats can save homeowners an average of 10-12% on heating costs and 15% on cooling costs. Combining a new, energy-efficient HVAC system with smart home technology can create a synergistic effect, maximizing energy savings and reducing your overall costs.

Tips for Improving Your Credit Score

While exploring financing options for bad credit is essential, simultaneously working to improve your credit score is equally important. A higher credit score will open up more financing options with better terms in the future.

- Pay Bills on Time: This is the most crucial factor in determining your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Credit Card Debt: Aim to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively impact your credit score.

- Check Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually. Dispute any errors or inaccuracies.

- Become an Authorized User: If you have a friend or family member with good credit, ask if they'll add you as an authorized user on their credit card. Their positive payment history can help boost your credit score.

- Consider a Secured Credit Card: Secured credit cards require a cash deposit as collateral. They're a good option for rebuilding credit because they report your payment activity to the credit bureaus.

Making the Right Choice

Financing an air conditioning unit with bad credit requires careful planning and research. By exploring all available options, comparing terms, and focusing on the long-term energy savings, you can make an informed decision that benefits both your comfort and your wallet. Remember to prioritize energy-efficient systems, leverage available rebates and incentives, and consider smart home integration to maximize your ROI. While navigating the financing process, simultaneously work to improve your credit score, which will open up more favorable financing opportunities in the future. Consulting with an HVAC professional and a financial advisor can provide personalized guidance and help you make the best choice for your specific circumstances.