Is A New Hvac System Tax Deductible 2024

Navigating the world of HVAC systems can feel like a maze, especially when factoring in costs and potential tax benefits. The question, "Is a new HVAC system tax deductible in 2024?" is a common one, and the answer, like most things tax-related, is nuanced. This article breaks down the eligibility requirements, available tax credits, and other crucial information to help homeowners, HVAC technicians, and facility managers understand the potential financial advantages of upgrading to a new, energy-efficient HVAC system in 2024.

Understanding Federal Tax Credits for Energy Efficiency

The primary source of tax benefits for new HVAC systems comes from federal tax credits designed to incentivize energy efficiency. These credits are often updated or modified, so staying current is critical. The cornerstone of these incentives is the Energy Efficient Home Improvement Credit, also known as 25C. This credit, extended and expanded by the Inflation Reduction Act of 2022, offers homeowners a significant opportunity to recoup some of the costs associated with energy-efficient upgrades.

How the 25C Energy Efficient Home Improvement Credit Works

The 25C tax credit allows homeowners to claim 30% of qualified expenses, including installation costs, for eligible energy-efficient home improvements, with annual limits. For HVAC systems, there are specific requirements to qualify.

Here's a breakdown of the key elements:

- Credit Amount: 30% of eligible expenses.

- Annual Limits: The overall annual limit is $3,200 for all energy-efficient home improvements combined. Within that limit, specific caps apply to certain items.

- Specific HVAC Caps:

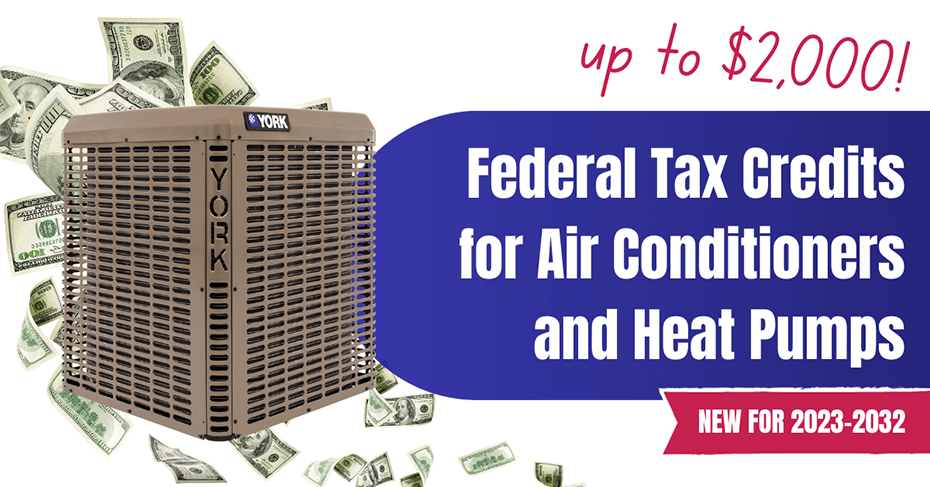

- Heat Pumps: Up to $2,000 for qualified electric or natural gas heat pumps.

- Central Air Conditioners: Up to $600 for qualified central air conditioners.

- Furnaces: Up to $600 for qualified natural gas, propane, or oil furnaces or hot water boilers.

- Eligibility Requirements: The equipment must meet or exceed specific energy efficiency standards set by the Department of Energy (DOE).

Example: Let's say you install a new, highly efficient heat pump and the total cost, including installation, is $10,000. You would be eligible for a tax credit of $2,000 (the maximum for heat pumps), calculated as 30% of the cost, capped at $2,000.

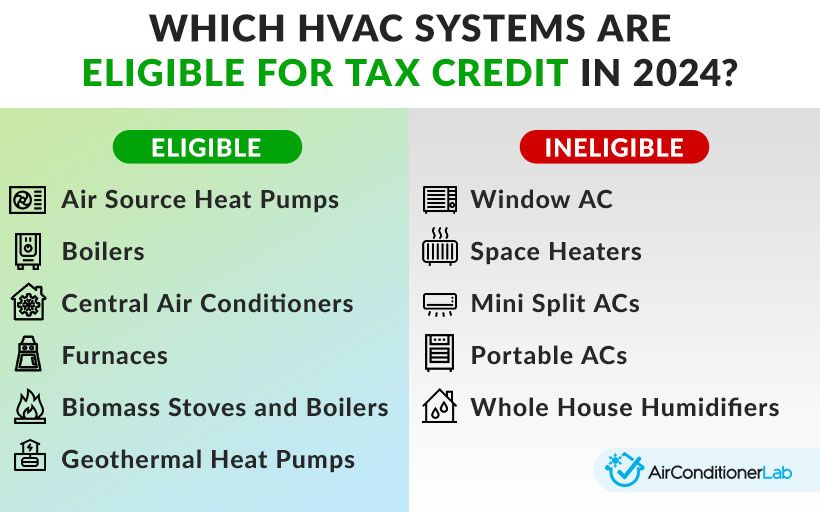

Qualifying HVAC Systems: Efficiency Standards Matter

The 25C tax credit isn't available for just any new HVAC system. The equipment must meet or exceed specific efficiency standards set by the DOE and outlined in the North American Efficiency Standards (NAECA). These standards are constantly evolving, so it's crucial to verify that the equipment you're considering meets the current requirements.

Here are some examples of the types of HVAC systems that typically qualify, along with the relevant efficiency metrics:

- Heat Pumps: Look for models with a high SEER2 (Seasonal Energy Efficiency Ratio 2) rating for cooling and a high HSPF2 (Heating Seasonal Performance Factor 2) rating for heating. Current minimums for tax credit eligibility often exceed the standard minimums required for new installations. Consult the Air Conditioning, Heating, and Refrigeration Institute (AHRI) directory for certified performance ratings.

- Central Air Conditioners: Similar to heat pumps, central AC units need to meet a specific SEER2 threshold. The higher the SEER2, the more efficient the unit and the more likely it is to qualify.

- Furnaces: Furnaces are rated by AFUE (Annual Fuel Utilization Efficiency). To qualify for the tax credit, furnaces generally need to have a high AFUE rating, often exceeding 95%.

Important Note: Always check the manufacturer's specifications and the AHRI directory to confirm that the HVAC system meets the specific efficiency requirements for the tax credit year. The *AHRI directory* provides a comprehensive listing of certified HVAC equipment and their performance ratings.

Navigating State and Local Incentives

In addition to federal tax credits, many states and local municipalities offer their own incentives for energy-efficient HVAC upgrades. These incentives can take the form of tax credits, rebates, or grants, further reducing the overall cost of a new system.

To find out about state and local incentives, consider these resources:

- DSIRE (Database of State Incentives for Renewables & Efficiency): This comprehensive database provides information on energy efficiency incentives across the United States.

- Your State Energy Office: Most states have an energy office that can provide information on state-specific programs.

- Local Utility Companies: Many utility companies offer rebates for installing energy-efficient HVAC equipment.

Example: A homeowner in California might be eligible for both the federal 25C tax credit and a rebate from their local utility company for installing a high-efficiency heat pump. These combined incentives can significantly offset the initial cost of the system.

Understanding the Limitations and Requirements

While the prospect of tax credits and rebates is appealing, it's important to understand the limitations and requirements associated with these incentives.

- Residency Requirement: The 25C tax credit generally applies to your primary residence. Vacation homes or rental properties may not be eligible.

- Documentation: Keep meticulous records of all expenses related to the HVAC upgrade, including invoices, receipts, and manufacturer's specifications. You'll need this documentation to claim the tax credit.

- Professional Installation: In many cases, the HVAC system must be installed by a qualified professional to be eligible for incentives.

- Filing the Correct Forms: You'll need to complete and file the correct tax forms to claim the credit. For the 25C credit, you'll typically use IRS Form 5695, Residential Energy Credits.

- Annual Income Limits: Some state and local incentives may have income restrictions.

The Long-Term Benefits of Energy-Efficient HVAC Systems

Beyond the immediate financial benefits of tax credits and rebates, upgrading to a new, energy-efficient HVAC system offers numerous long-term advantages:

- Reduced Energy Bills: Energy-efficient systems consume less energy, resulting in lower monthly utility bills. The savings can be substantial over the lifespan of the system.

- Improved Comfort: Modern HVAC systems provide more consistent and comfortable temperatures throughout your home or building.

- Enhanced Air Quality: Many new systems include advanced air filtration technologies that can improve indoor air quality, reducing allergens and pollutants.

- Increased Property Value: Energy-efficient upgrades can increase the value of your property.

- Environmental Benefits: By reducing energy consumption, you're contributing to a smaller carbon footprint and a more sustainable future.

Tips for HVAC Technicians and Installers

For HVAC technicians and installers, staying informed about tax credits and incentives is crucial for providing value to your customers. Here are some tips:

- Stay Updated: Keep abreast of the latest federal, state, and local incentives for energy-efficient HVAC systems.

- Educate Your Customers: Inform your customers about the potential tax credits and rebates they may be eligible for.

- Recommend Qualifying Equipment: Suggest HVAC systems that meet or exceed the efficiency standards required for incentives.

- Provide Documentation: Provide your customers with the necessary documentation, such as invoices and manufacturer's specifications, to claim the tax credits.

- Partner with Accountants: Consider partnering with local tax professionals to provide your customers with expert advice on tax-related matters.

Conclusion: Investing in Efficiency

While the tax landscape can be complex, the potential tax benefits associated with new, energy-efficient HVAC systems in 2024 are significant. By understanding the eligibility requirements, available tax credits, and long-term benefits, homeowners, HVAC technicians, and facility managers can make informed decisions about upgrading their HVAC systems. Remember to consult with a qualified tax professional to determine your specific eligibility and maximize your potential savings. Upgrading to a new HVAC system is an investment in your comfort, your property value, and a more sustainable future. Investing in energy efficiency often pays off in the long run, even without considering the tax incentives. Take time to assess your needs and weigh the costs and potential savings to see if an upgrade makes sense for you.