Is There A Tax Credit For New Hvac System

Navigating HVAC Tax Credits: A Homeowner's Guide

Upgrading your heating, ventilation, and air conditioning (HVAC) system is a significant investment for any homeowner. Beyond the immediate comfort and improved air quality, a new, energy-efficient system can lead to long-term savings on utility bills. To further offset the initial cost, many homeowners wonder: Is there a tax credit for a new HVAC system? The answer is generally yes, but eligibility depends on several factors, including the system's efficiency ratings and the prevailing federal, state, and local regulations.

Federal Tax Credits: The Inflation Reduction Act and Beyond

The most significant incentive currently available is through the Inflation Reduction Act (IRA), signed into law in 2022. This act offers substantial tax credits for homeowners who install energy-efficient HVAC equipment. Prior to the IRA, smaller credits were sometimes available, and it's essential to understand the current landscape to maximize potential savings.

Key Provisions of the Inflation Reduction Act for HVAC

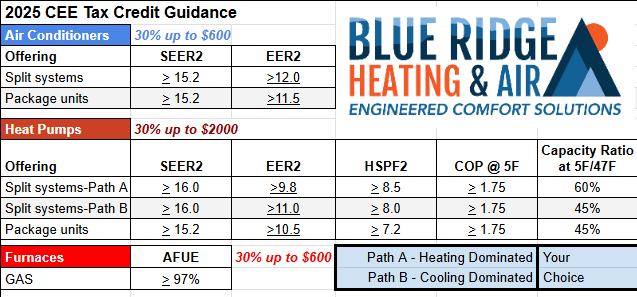

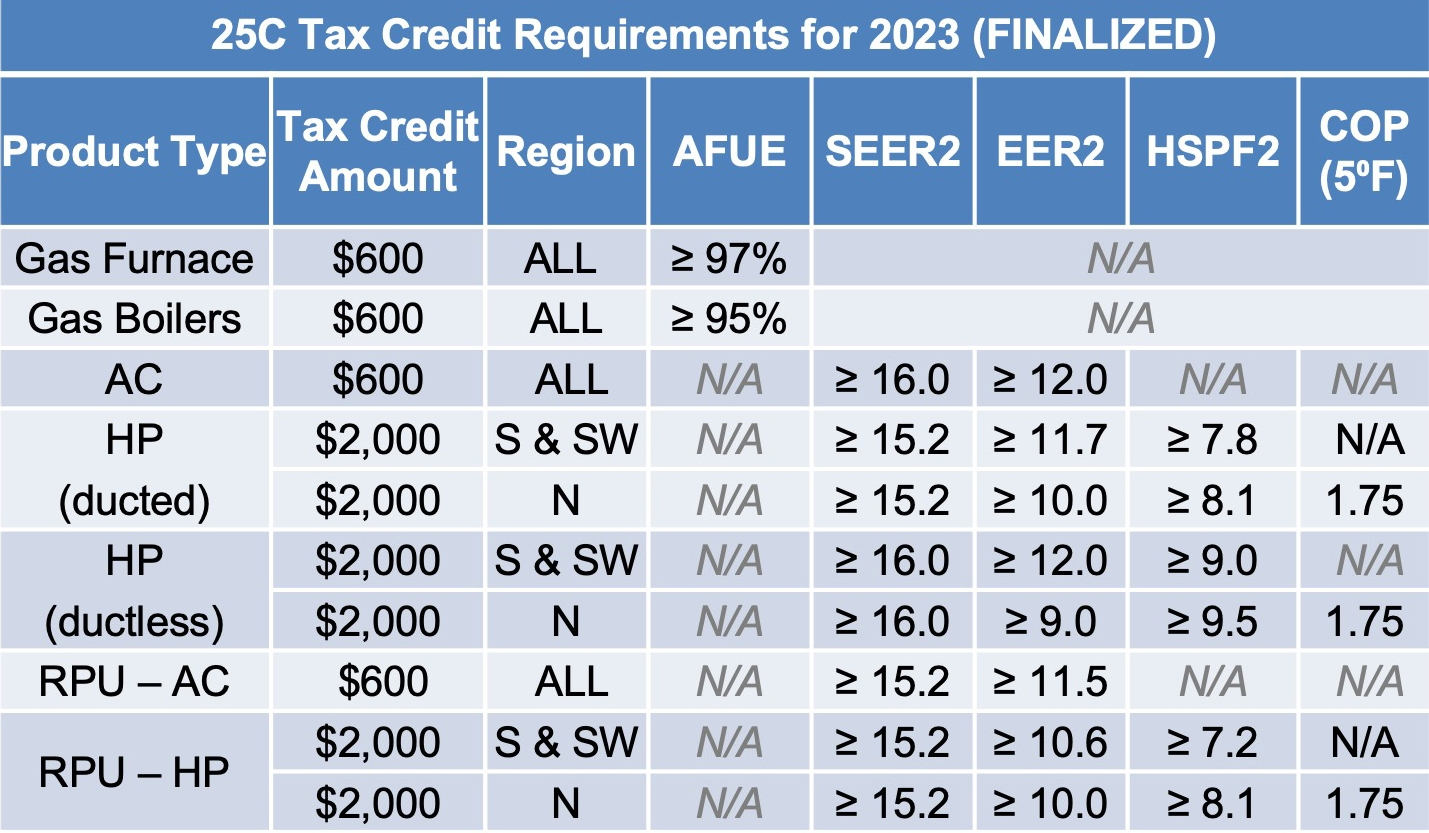

The IRA offers a tax credit for 30% of the cost of qualified energy-efficient home improvements, including HVAC systems, up to a certain limit. This limit varies depending on the specific type of equipment. For example:

- Heat Pumps: Highly efficient heat pumps, which provide both heating and cooling, are eligible for the 30% tax credit, with a maximum annual credit of $2,000. This is a major incentive for homeowners in moderate climates.

- Air Conditioners and Furnaces: While heat pumps receive the largest incentive, certain high-efficiency air conditioners and furnaces also qualify for a credit. However, the maximum annual credit for all energy efficiency improvements (excluding heat pumps, heat pump water heaters, and biomass stoves/heaters) is $1,200.

Eligibility Requirements: To qualify for the federal tax credit, your new HVAC system must meet specific energy efficiency standards. These standards are typically defined by the Energy Star program. Always check the Energy Star website or consult with a qualified HVAC contractor to ensure your chosen system meets these requirements.

Energy Efficiency Ratings: AFUE, SEER, and HSPF

Understanding energy efficiency ratings is crucial when selecting an HVAC system and determining tax credit eligibility. The most common ratings include:

- AFUE (Annual Fuel Utilization Efficiency): This rating applies to furnaces and measures how efficiently the furnace converts fuel into heat. A higher AFUE indicates better efficiency. Generally, furnaces with an AFUE of 95% or higher are considered high-efficiency and may qualify for tax credits.

- SEER (Seasonal Energy Efficiency Ratio): This rating applies to air conditioners and measures how efficiently the unit cools your home. A higher SEER indicates better efficiency. Many of the air conditioners eligible for tax credits have SEER ratings of 16 or higher.

- HSPF (Heating Seasonal Performance Factor): This rating applies to heat pumps and measures how efficiently the unit heats your home. A higher HSPF indicates better efficiency. Qualifying heat pumps often have HSPF ratings of 8.5 or higher.

When comparing HVAC systems, pay close attention to these ratings to ensure you're choosing a model that's both energy-efficient and eligible for tax credits.

State and Local Incentives: Maximizing Your Savings

In addition to federal tax credits, many states and local municipalities offer their own incentives for energy-efficient HVAC upgrades. These incentives can take the form of tax credits, rebates, or grants. Researching these local options can significantly reduce the overall cost of your new HVAC system.

How to Find State and Local Incentives:

- Database of State Incentives for Renewables & Efficiency (DSIRE): This website is a comprehensive resource for finding state and local incentives for renewable energy and energy efficiency.

- Your State Energy Office: Contact your state energy office for information on available programs and incentives in your area.

- Your Local Utility Company: Many utility companies offer rebates or incentives for energy-efficient appliances, including HVAC systems.

Popular HVAC Brands and Models: A Comparison

Choosing the right HVAC system can be overwhelming, with numerous brands and models available. Here's a brief comparison of some popular options, keeping in mind that specific models and their efficiency ratings may vary:

- Carrier: Known for its high-efficiency and advanced features, Carrier offers a wide range of HVAC systems. Their Infinity series heat pumps and air conditioners often boast high SEER and HSPF ratings, making them eligible for tax credits.

- Trane: Trane is another reputable brand known for its durability and reliability. Their XV series variable-speed heat pumps and air conditioners offer excellent energy efficiency.

- Lennox: Lennox is recognized for its innovative technology and energy-efficient designs. Their Dave Lennox Signature Collection includes some of the most efficient HVAC systems on the market.

- Goodman: Goodman offers a more budget-friendly option without sacrificing quality or efficiency. While their systems may not be as feature-rich as some higher-end brands, they still offer models that meet the requirements for tax credits.

- Rheem: Rheem offers a diverse range of HVAC systems, catering to various budgets and needs. Their Prestige Series heat pumps and air conditioners are known for their efficiency and smart home integration capabilities.

Example Model: The Carrier Infinity 26 heat pump often boasts SEER ratings above 20 and HSPF ratings exceeding 10, making it a prime candidate for federal tax credits. Similarly, the Trane XV20i variable speed air conditioner can reach SEER ratings of up to 22.

Important Note: Always verify the specific model's efficiency ratings and eligibility for tax credits with the manufacturer or your HVAC contractor before making a purchase.

Warranties and Maintenance: Protecting Your Investment

A new HVAC system is a significant investment, so it's essential to protect it with a comprehensive warranty and proper maintenance. Most manufacturers offer warranties on their equipment, covering parts and labor for a specified period.

Warranty Coverage:

- Parts Warranty: This covers the cost of replacement parts if a component fails due to a manufacturing defect. Standard parts warranties typically range from 5 to 10 years.

- Labor Warranty: This covers the cost of labor for repairs. Labor warranties are often shorter than parts warranties, typically ranging from 1 to 2 years.

- Extended Warranties: Many manufacturers offer extended warranties that provide additional coverage beyond the standard warranty period. These warranties can offer peace of mind and protect you from unexpected repair costs.

Maintenance Needs:

- Regular Filter Changes: Changing your air filter regularly (typically every 1-3 months) is essential for maintaining optimal performance and air quality.

- Annual Tune-Ups: Scheduling annual tune-ups with a qualified HVAC technician can help identify and address potential problems before they escalate into costly repairs.

- Coil Cleaning: Keeping the indoor and outdoor coils clean is crucial for efficient heat transfer.

Financing Options for New HVAC Systems

If you're concerned about the upfront cost of a new HVAC system, several financing options are available:

- Home Equity Loans or Lines of Credit (HELOC): These options allow you to borrow against the equity in your home.

- Personal Loans: Unsecured personal loans can be used to finance a variety of expenses, including HVAC upgrades.

- HVAC Financing Programs: Many HVAC contractors offer financing programs through their own lenders or partnerships with financial institutions. These programs often offer competitive interest rates and flexible repayment terms.

The Bottom Line: Is a New HVAC System Worth the Investment?

While the initial cost of a new HVAC system can be substantial, the long-term benefits often outweigh the expense. Energy-efficient systems can significantly reduce your utility bills, improve indoor air quality, and increase the value of your home. Furthermore, the availability of federal, state, and local tax credits can help offset the initial cost, making a new HVAC system a smart investment for homeowners looking to improve their comfort and save money.

Consulting with a Qualified HVAC Contractor

Before making any decisions about replacing your HVAC system, it's crucial to consult with a qualified and licensed HVAC contractor. A contractor can assess your home's specific needs, recommend the appropriate system size and efficiency, and help you navigate the complex world of tax credits and rebates. They can also provide accurate cost estimates and ensure that your new system is installed correctly and safely.

Remember to ask potential contractors for their license information, insurance coverage, and references. A reputable contractor will be happy to provide this information and answer any questions you may have.