Jefferson Capital Systems Llc Text Message

Are you getting unexpected text messages? In today's world, understanding potential scams is crucial. While a text from Jefferson Capital Systems LLC might seem alarming, it’s essential to understand what it is and how it relates to your home's energy efficiency and financial well-being. This article will explore the connection between energy efficiency, debt management, and unexpected communications, providing you with actionable steps to protect yourself and your finances.

Understanding Jefferson Capital Systems LLC

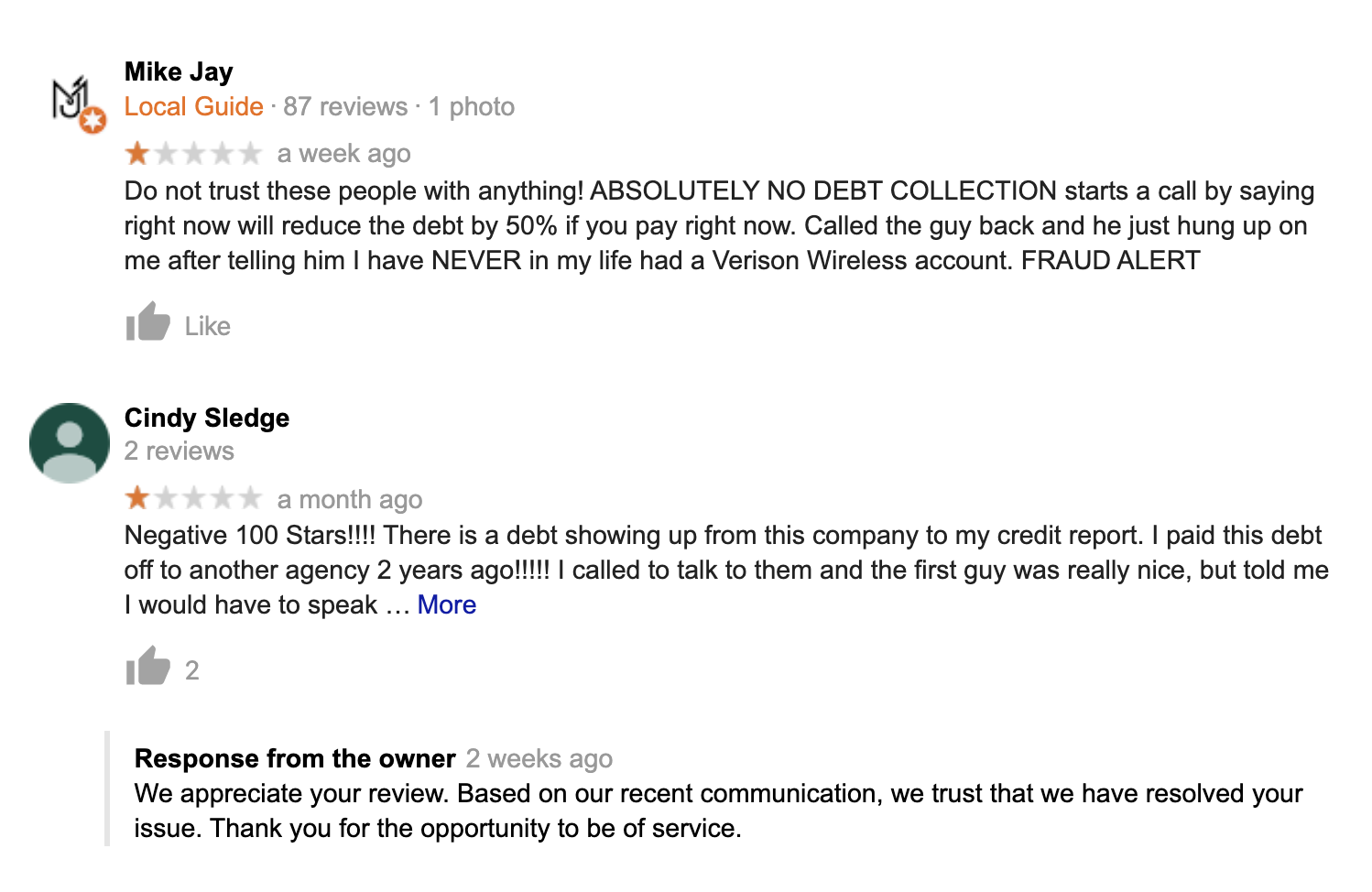

Jefferson Capital Systems LLC is a debt collection agency. Receiving a text message from them typically means they believe you owe a debt, possibly related to unpaid utility bills, credit cards, or other financial obligations. While seemingly unrelated to HVAC systems and energy efficiency, understanding this connection can surprisingly impact your long-term financial health and ability to invest in energy-saving home improvements.

Ignoring such communications can have severe consequences, including lowered credit scores, potential lawsuits, and even wage garnishment. However, it's equally crucial to verify the legitimacy of the debt before taking any action. Many scams impersonate legitimate companies, so due diligence is vital.

Is it a Scam? Red Flags to Watch Out For

Before you panic and start thinking about liquidating assets to pay off a perceived debt, consider these red flags that indicate a possible scam:

- Lack of Specific Information: A vague text message without detailed account information or the original creditor's name should raise suspicion.

- Pressure Tactics: Demands for immediate payment or threats of legal action without proper documentation are common scam tactics.

- Requests for Personal Information: Never provide sensitive information like your social security number, bank account details, or credit card numbers via text message or over the phone without verifying the legitimacy of the request.

- Unfamiliar Debt: If you don’t recognize the debt, it’s highly suspicious.

If any of these red flags appear, do not engage with the sender. Instead, follow the verification steps outlined below.

Verifying the Debt and Protecting Yourself

Before acknowledging or paying any debt, it's crucial to verify its legitimacy. Here’s a step-by-step guide:

- Request Debt Validation: Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request written validation of the debt. Send a certified letter to Jefferson Capital Systems LLC requesting them to provide proof of the debt, including the original creditor's name, the account number, the amount owed, and documentation showing you are responsible for the debt. They are legally obligated to provide this information.

- Check Your Credit Report: Review your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). You can obtain free copies of your reports annually at www.annualcreditreport.com. Look for the debt in question. If it’s not listed or the information is inaccurate, dispute it with the credit bureau.

- Contact the Original Creditor: If you recognize the original creditor, contact them directly to confirm whether they sold the debt to Jefferson Capital Systems LLC.

- Report Suspicious Activity: If you believe you’ve been targeted by a scam, report it to the Federal Trade Commission (FTC) at www.ftc.gov and your state's attorney general.

The Link Between Debt Management and Energy Efficiency

You might wonder, what does debt collection have to do with HVAC systems and energy efficiency? The connection is more direct than you might think. Financial stability is critical for investing in energy-efficient upgrades. Here's how they intertwine:

- Investment Capital: Clearing up debts frees up capital to invest in energy-efficient upgrades like high-efficiency HVAC systems, insulation improvements, and smart thermostats.

- Credit Score Impact: A good credit score enables you to secure loans or financing options for energy-efficient home improvements at favorable interest rates. Conversely, a damaged credit score due to unpaid debts can limit your access to these resources.

- Reduced Utility Bills: Efficient HVAC systems and energy-saving upgrades reduce your monthly utility bills, freeing up more of your budget to manage existing debts or invest in further improvements.

Investing in Energy Efficiency: A Path to Financial Freedom

Once you've addressed any potential debt issues, consider investing in energy-efficient upgrades for your home. These improvements not only reduce your carbon footprint but also lower your monthly expenses and increase your home's value.

Energy-Efficient HVAC Systems

Upgrading to a high-efficiency HVAC system is one of the most impactful energy-saving investments you can make. Look for systems with high Seasonal Energy Efficiency Ratio (SEER) ratings for air conditioners and Annual Fuel Utilization Efficiency (AFUE) ratings for furnaces. Energy Star certified models are guaranteed to meet strict energy efficiency standards.

ROI Example: A new Energy Star certified air conditioner with a SEER rating of 16 or higher can reduce cooling costs by up to 20% compared to an older, less efficient model. For a home that spends $1,000 annually on cooling, this translates to $200 in savings per year. Over the system's lifespan, these savings can easily offset the initial investment.

Smart Thermostats and Sensors

Smart thermostats learn your heating and cooling preferences and automatically adjust the temperature to optimize energy consumption. They can also be controlled remotely via smartphone, allowing you to adjust the temperature even when you’re not at home. Integrating smart sensors throughout your home can further enhance energy efficiency by detecting occupancy and adjusting temperature settings accordingly.

Benefits:

- Remote Control: Adjust temperature settings from anywhere.

- Learning Algorithms: Adapt to your habits and optimize energy usage.

- Energy Reports: Track your energy consumption and identify areas for improvement.

- Zoning Control: Control temperatures in different zones of your home.

Insulation and Air Sealing

Proper insulation and air sealing are crucial for preventing heat loss in the winter and heat gain in the summer. Insulating your attic, walls, and floors can significantly reduce your heating and cooling costs. Sealing air leaks around windows, doors, and other openings prevents conditioned air from escaping and unconditioned air from entering your home.

Data Point: According to the U.S. Department of Energy, homeowners can save up to 15% on heating and cooling costs by properly insulating their homes and sealing air leaks.

Rebates and Incentives for Energy-Efficient Upgrades

Many utility companies and government agencies offer rebates and incentives for energy-efficient upgrades. Take advantage of these programs to reduce the upfront cost of these investments. Examples include:

- Federal Tax Credits: The federal government offers tax credits for qualified energy-efficient home improvements.

- State and Local Rebates: Many states and local municipalities offer rebates for installing Energy Star certified appliances, HVAC systems, and insulation.

- Utility Company Programs: Your local utility company may offer rebates, incentives, or financing options for energy-efficient upgrades.

Always check the Energy Star website and your local utility company's website for the latest information on available rebates and incentives.

HVAC Contractors: Partnering for Energy Efficiency

For HVAC contractors, understanding the relationship between debt management, energy efficiency, and potential scams is crucial for building trust with clients. Offering financing options for energy-efficient upgrades can help homeowners overcome financial barriers and make these investments more accessible. Highlighting available rebates and incentives can further sweeten the deal and demonstrate your commitment to helping customers save money and reduce their environmental impact.

Furthermore, being able to discuss, and even advise, on the potential risks of scams targeting homeowners makes you a trusted advisor, not just a service provider.

Conclusion: Taking Control of Your Finances and Your Energy Consumption

Receiving a text message from Jefferson Capital Systems LLC can be unsettling, but it's important to approach the situation with a clear head and a proactive strategy. Verify the debt, protect yourself from scams, and prioritize your financial stability. Once you've addressed any potential debt issues, invest in energy-efficient upgrades for your home to reduce your utility bills, increase your home's value, and contribute to a more sustainable future. By taking control of your finances and your energy consumption, you can create a more secure and comfortable future for yourself and your family.

Remember to always be vigilant, informed, and proactive in protecting your finances and your home. Energy efficiency and financial stability are intertwined, and by addressing both, you can pave the way for a more prosperous and sustainable future.