Tax Credit For Replacing Air Conditioner

Navigating the Tax Credit Landscape for Air Conditioner Replacements: A Guide to Savings and Sustainability

As homeowners and businesses alike strive for energy efficiency and reduced utility bills, understanding available incentives for upgrading to modern, high-efficiency air conditioning systems is crucial. This comprehensive guide delves into the intricacies of the tax credits and rebates available for replacing your air conditioner, offering insights into eligibility, potential savings, and the benefits of integrating smart home technology.

The Power of Federal Tax Credits: Making Energy Efficiency Affordable

The cornerstone of financial assistance for energy-efficient HVAC upgrades is the federal tax credit, outlined in the Inflation Reduction Act of 2022. This legislation provides significant incentives for both homeowners and businesses investing in qualified energy-efficient equipment.

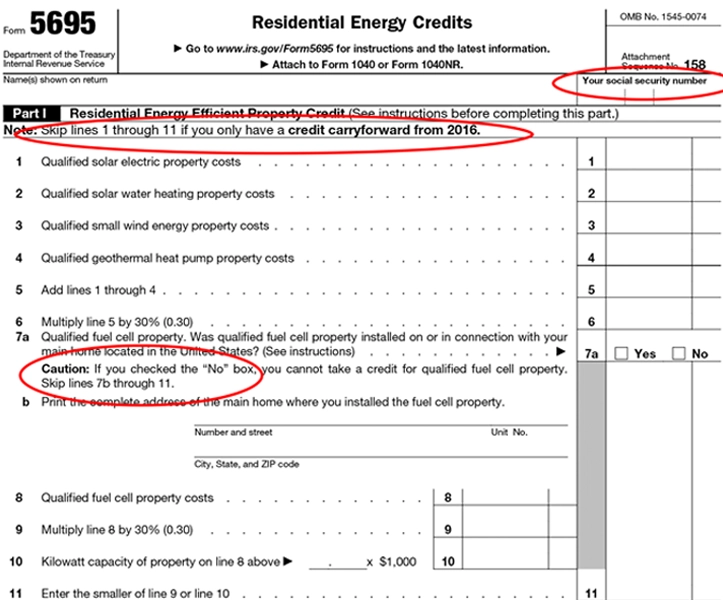

Homeowners: The 25C Tax Credit

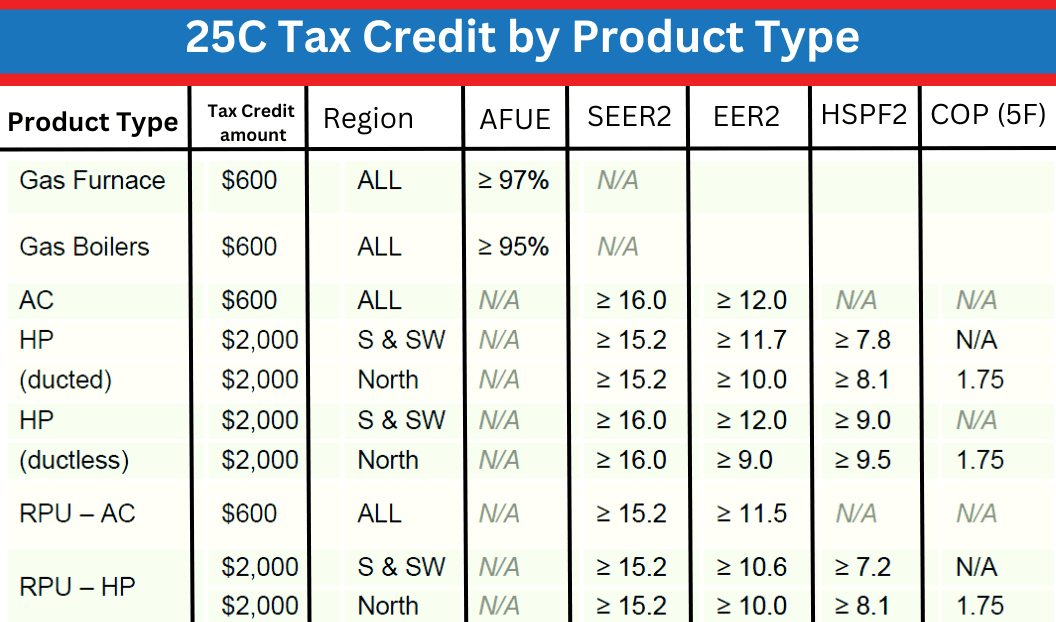

For residential applications, the 25C tax credit offers a substantial opportunity to reduce the upfront cost of a new, efficient air conditioner. Specifically, you can claim 30% of the cost of qualified energy-efficient improvements, including installation costs, up to a maximum of $2,000 for heat pumps and air conditioners combined. This maximum is applied annually, meaning you can claim additional credits in subsequent years for other qualifying improvements.

To qualify for the 25C tax credit, your new air conditioner must meet specific efficiency standards set by Energy Star. Generally, this means achieving a Seasonal Energy Efficiency Ratio (SEER) of 16 or higher and an Energy Efficiency Ratio (EER) of 12.5 or higher. Be sure to consult the Energy Star website or a qualified HVAC contractor to confirm that the model you're considering meets these criteria. Keep detailed records, including receipts and manufacturer specifications, as you'll need them when filing your taxes.

Businesses: The 179D Tax Deduction

Businesses can benefit from the 179D tax deduction, designed to incentivize energy-efficient commercial building improvements. This deduction allows businesses to deduct up to $5.00 per square foot of building space for qualifying energy-efficient upgrades, including HVAC systems. The amount of the deduction depends on the level of energy savings achieved. To qualify for the full $5.00 per square foot deduction, the new HVAC system must reduce total annual energy and power costs by at least 25% compared to a reference building meeting minimum energy codes.

Unlike the residential credit, the 179D deduction requires a qualified professional to certify that the new HVAC system meets the energy efficiency requirements. Consult with a licensed engineer or architect to ensure your project qualifies and to obtain the necessary documentation.

Beyond Federal Incentives: State and Local Rebates

In addition to federal tax credits, many states and local utility companies offer rebates and incentives for installing energy-efficient air conditioners. These programs can further reduce the overall cost of upgrading your system. The Database of State Incentives for Renewables & Efficiency (DSIRE) is an excellent resource for finding rebates and incentives available in your area.

These rebates often have specific requirements, such as purchasing equipment from a participating vendor or using a certified installer. Be sure to research the eligibility criteria and application process before making your purchase. Combining federal tax credits with state and local rebates can significantly reduce your upfront investment and accelerate the payback period.

Smart HVAC Integration: Maximizing Efficiency and Control

Integrating your new air conditioner with smart home technology can unlock even greater energy savings and enhance comfort. Smart thermostats, sensors, and zoning systems allow you to precisely control the temperature in different areas of your home, optimizing energy usage and reducing wasted cooling.

For example, a smart thermostat can learn your daily routines and automatically adjust the temperature when you're away from home, ensuring that you're not cooling an empty house. Zoning systems allow you to control the temperature in individual rooms or zones, so you can focus cooling efforts on occupied areas. Smart sensors can detect occupancy and adjust the temperature accordingly, further optimizing energy usage.

Many smart HVAC systems can be controlled remotely via a smartphone app, allowing you to adjust the temperature from anywhere. Some systems also offer advanced features like energy monitoring and reporting, providing valuable insights into your energy consumption patterns. In addition to the direct energy savings, integrating your HVAC system with smart home technology can increase your home's value and appeal to potential buyers.

Calculating Your Return on Investment (ROI)

When evaluating an air conditioner replacement, it's crucial to consider the long-term return on investment (ROI). While the upfront cost of a high-efficiency system may be higher, the energy savings can quickly offset the initial investment. To calculate your ROI, you'll need to estimate your annual energy savings and compare them to the incremental cost of the new system.

To estimate your energy savings, compare the SEER and EER ratings of your old and new air conditioners. A higher SEER and EER rating indicates greater energy efficiency. Consult your utility bills to determine your current energy consumption and costs. Use online energy calculators or consult with an HVAC professional to estimate your potential savings.

For example, upgrading from a SEER 10 air conditioner to a SEER 16 model can reduce your cooling costs by as much as 40%. Over time, these savings can add up to thousands of dollars, making the investment in a high-efficiency system well worthwhile. Factor in the tax credits and rebates you'll receive to further reduce your net cost and accelerate your ROI.

Choosing the Right HVAC Contractor: Expertise and Certification Matter

Selecting a qualified HVAC contractor is essential for ensuring a successful air conditioner replacement. Look for a contractor with the following qualifications:

- License and Insurance: Verify that the contractor is licensed and insured to operate in your area.

- Experience: Choose a contractor with extensive experience installing and servicing energy-efficient HVAC systems.

- Certifications: Look for contractors who are certified by organizations such as NATE (North American Technician Excellence) or ACCA (Air Conditioning Contractors of America). These certifications indicate that the contractor has met rigorous training and testing standards.

- References: Ask for references from previous customers and check online reviews to gauge the contractor's reputation.

- Detailed Proposals: Obtain detailed proposals from multiple contractors that clearly outline the scope of work, equipment specifications, and costs.

A qualified HVAC contractor can help you select the right air conditioner for your home or business, ensure proper installation, and provide ongoing maintenance and support. They can also help you navigate the complex landscape of tax credits and rebates, ensuring that you receive all the incentives you're eligible for.

Understanding SEER, EER, and HSPF: Key Efficiency Metrics

When shopping for a new air conditioner, it's important to understand the key efficiency metrics that indicate its energy performance. The most important metrics are:

- SEER (Seasonal Energy Efficiency Ratio): Measures the cooling efficiency of an air conditioner over an entire cooling season. A higher SEER rating indicates greater energy efficiency.

- EER (Energy Efficiency Ratio): Measures the cooling efficiency of an air conditioner at a specific operating point (typically 95°F). A higher EER rating indicates greater energy efficiency.

- HSPF (Heating Seasonal Performance Factor): This metric applies to heat pumps and measures their heating efficiency. A higher HSPF rating indicates greater energy efficiency.

Energy Star sets minimum efficiency standards for air conditioners to qualify for their label. Look for the Energy Star label when shopping for a new air conditioner to ensure that you're purchasing a high-efficiency model. Remember, air conditioning systems with higher SEER and EER ratings are likely to qualify for the 25C federal tax credit.

The Future of Sustainable HVAC: Embracing Innovation

The HVAC industry is constantly evolving, with new technologies emerging to improve energy efficiency and reduce environmental impact. Some of the most promising innovations include:

- Variable Speed Compressors: These compressors can adjust their speed based on cooling demand, providing more precise temperature control and reducing energy consumption.

- Smart Controls: Advanced algorithms and machine learning are being used to optimize HVAC system performance and predict potential problems.

- Eco-Friendly Refrigerants: New refrigerants with lower global warming potential are being developed to replace traditional refrigerants.

By embracing these innovations, you can further reduce your energy consumption and contribute to a more sustainable future. As technology advances and becomes more readily available, the price point for these new systems will continue to drop.

Conclusion: Investing in a Sustainable Future

Replacing your air conditioner with a high-efficiency model is a smart investment that can save you money, enhance comfort, and reduce your environmental impact. By taking advantage of federal tax credits, state and local rebates, and smart home technology, you can significantly reduce the upfront cost and accelerate the payback period. Choose a qualified HVAC contractor, understand the key efficiency metrics, and stay informed about the latest innovations in sustainable HVAC to maximize your savings and contribute to a more sustainable future. Remember to keep thorough records to ensure you are able to properly submit for any rebates or tax incentives you may qualify for.