Tax Credits For Central Air Conditioning

Navigating Tax Credits for Central Air Conditioning: A Comprehensive Guide

Upgrading your home's central air conditioning system is a significant investment, but it can lead to improved comfort, energy efficiency, and potentially, lower utility bills. One factor that can ease the financial burden is the availability of tax credits. These credits, often offered by federal, state, or local governments, aim to incentivize the purchase of energy-efficient HVAC equipment. This guide will walk you through understanding these credits, determining your eligibility, and maximizing your savings.

Understanding HVAC Efficiency Ratings: SEER, EER, and HSPF

Before diving into tax credits, it's crucial to understand the key efficiency ratings that determine a central air conditioner's performance. These ratings are pivotal in determining eligibility for tax incentives.

- SEER (Seasonal Energy Efficiency Ratio): This is the most common rating for central AC systems. It measures the cooling output during a typical cooling season divided by the total electric energy input during the same period. Higher SEER ratings indicate greater energy efficiency. Current minimum SEER standards are 14 in the Northern United States and 15 in the Southeast and Southwest. Many tax credits require a SEER rating of 16 or higher.

- EER (Energy Efficiency Ratio): EER measures the cooling efficiency of an AC unit at a specific operating point, usually at 95°F outdoor temperature. While SEER provides a seasonal average, EER offers a snapshot of performance under peak conditions.

- HSPF (Heating Seasonal Performance Factor): While primarily relevant for heat pumps (which can both heat and cool), HSPF measures the heating efficiency of the unit. Since many modern HVAC systems are heat pumps, it's important to understand this rating as well.

Federal Tax Credits for Energy Efficiency: The Inflation Reduction Act

The Inflation Reduction Act (IRA) of 2022 significantly expanded and extended federal tax credits for energy-efficient home improvements, including HVAC systems. This act provides a substantial incentive for homeowners looking to upgrade to more efficient air conditioning.

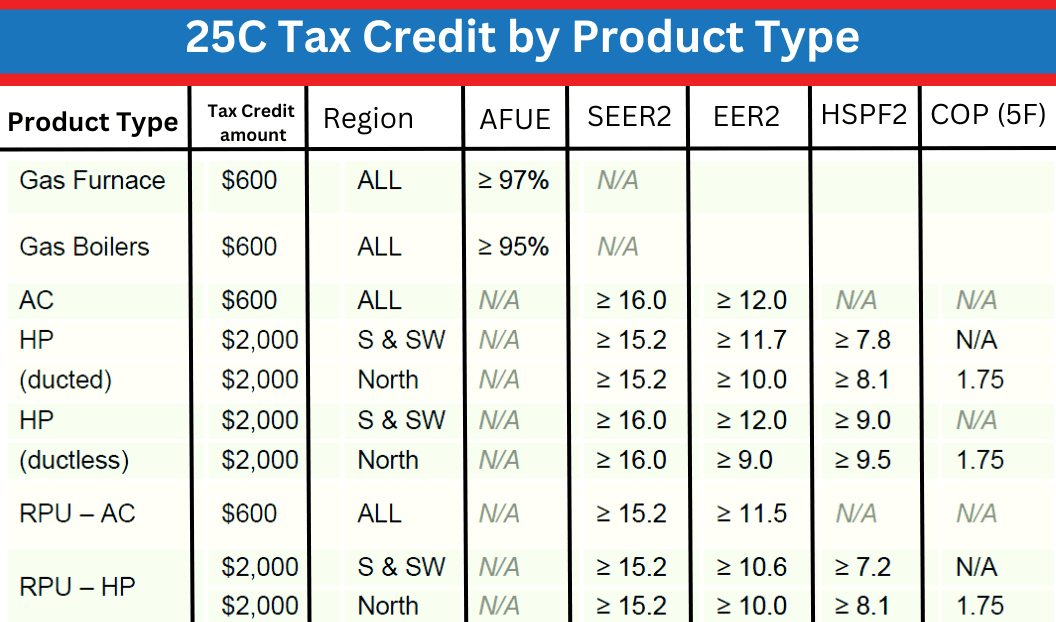

Key Provisions of the Inflation Reduction Act for HVAC:

- Energy Efficient Home Improvement Credit (25C): This credit offers a tax credit for up to 30% of qualified expenses for energy-efficient home improvements, including central air conditioners and heat pumps. The maximum annual credit is capped at $2,000 for heat pumps, furnaces, and water heaters combined. For central air conditioners, the maximum annual credit is also capped at $2,000.

- New Energy Efficient Home Credit (45L): This credit is primarily for builders of new energy-efficient homes. However, it can indirectly benefit homeowners by encouraging builders to install highly efficient HVAC systems.

Eligibility Requirements for Federal Tax Credits:

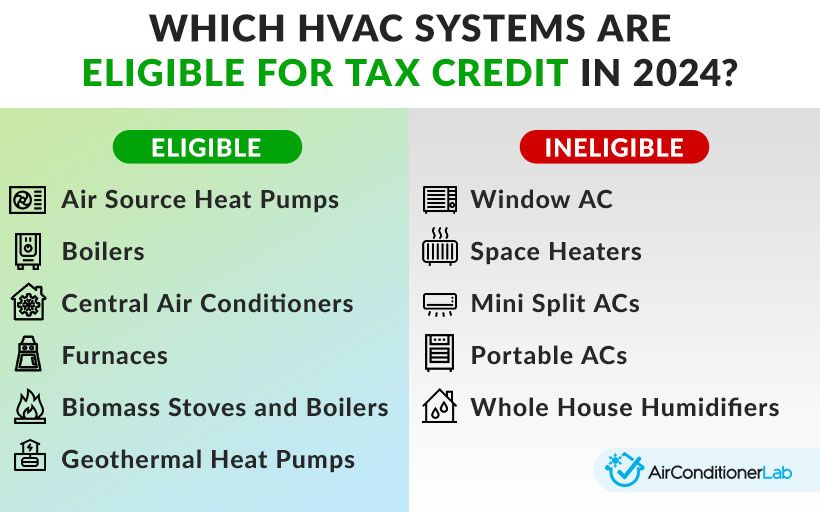

To qualify for federal tax credits under the IRA, your central air conditioning system must meet specific requirements:

- Energy Efficiency Standards: The system must meet or exceed the efficiency standards set by the Consortium for Energy Efficiency (CEE). These standards vary depending on the type of equipment and region. Consult the CEE directory or your HVAC contractor for the most up-to-date requirements.

- Installation: The system must be installed in your primary residence.

- Documentation: You'll need to keep detailed records of your purchase, including receipts and manufacturer specifications, to claim the credit on your tax return.

State and Local Tax Credits and Rebates

In addition to federal tax credits, many states, cities, and utility companies offer their own incentives for energy-efficient HVAC systems. These incentives can take the form of tax credits, rebates, or grants.

How to Find State and Local Incentives:

- DSIRE (Database of State Incentives for Renewables & Efficiency): The DSIRE website (www.dsireusa.org) is a comprehensive resource for finding state and local incentives for renewable energy and energy efficiency.

- Your Local Utility Company: Contact your local utility company to inquire about available rebates and incentives for energy-efficient HVAC systems.

- Your HVAC Contractor: A knowledgeable HVAC contractor can often provide information about available incentives in your area.

Popular Central Air Conditioning Brands and Models

Choosing the right brand and model is crucial for maximizing energy efficiency and taking advantage of tax credits. Here are a few popular brands known for their high-efficiency offerings:

- Carrier: Carrier is a well-established brand known for its innovative and energy-efficient HVAC systems. Their Infinity series features models with SEER ratings up to 26.

- Trane: Trane is another reputable brand offering a wide range of central air conditioners with high SEER ratings. Their XV20i model boasts a SEER rating of up to 20.

- Lennox: Lennox is known for its premium HVAC systems and energy-efficient technology. Their SL28XCV model offers a SEER rating of up to 28.

- Goodman: Goodman provides more affordable options without sacrificing quality or efficiency. While perhaps not reaching the peak SEER ratings of the brands above, they can still qualify for many tax credits.

Example Model Comparison:

| Brand | Model | SEER Rating | Estimated Price (Installed) |

|---|---|---|---|

| Carrier | Infinity 26 | Up to 26 | $5,000 - $8,000 |

| Trane | XV20i | Up to 20 | $4,500 - $7,500 |

| Lennox | SL28XCV | Up to 28 | $6,000 - $9,000 |

| Goodman | GSX16 | Up to 16 | $3,500 - $5,500 |

Note: Prices are estimates and can vary depending on location, installation complexity, and contractor.

Warranties and Maintenance

When investing in a new central air conditioning system, it's essential to understand the warranty coverage and maintenance requirements.

Warranty Considerations:

- Compressor Warranty: The compressor is the heart of the AC unit, and its warranty is crucial. Look for models with a 10-year compressor warranty.

- Parts Warranty: A comprehensive parts warranty covers other components of the system. A 5-10 year parts warranty is common.

- Labor Warranty: Some manufacturers offer labor warranties, which cover the cost of labor for repairs. These warranties can be a valuable asset.

Maintenance Needs:

- Regular Filter Changes: Changing your air filter regularly (every 1-3 months) is essential for maintaining system efficiency and air quality.

- Annual Maintenance: Schedule an annual maintenance check with a qualified HVAC technician. This checkup should include cleaning the coils, inspecting the refrigerant levels, and checking the electrical connections.

- Coil Cleaning: Dirty coils can significantly reduce the efficiency of your AC unit. Have the coils cleaned regularly by a professional.

Maximizing Your Savings: Combining Tax Credits and Rebates

The most effective way to reduce the cost of upgrading your central air conditioning system is to combine federal, state, and local tax credits and rebates. Here's how:

- Research Available Incentives: Use the DSIRE database and contact your local utility company to identify all available tax credits and rebates in your area.

- Choose an Energy-Efficient System: Select a central air conditioner that meets the eligibility requirements for all applicable incentives.

- Document Everything: Keep detailed records of your purchase, including receipts, manufacturer specifications, and installation records.

- File Your Taxes Correctly: Claim the applicable tax credits on your federal and state tax returns. Consult with a tax professional if you have any questions.

Common Mistakes to Avoid

Navigating the world of HVAC tax credits can be complex. Here are some common mistakes to avoid:

- Not verifying eligibility requirements: Ensure that the system you choose meets the specific energy efficiency standards required for the tax credits and rebates you're pursuing.

- Failing to keep proper documentation: Keep all receipts, manufacturer specifications, and installation records organized and readily available.

- Missing deadlines: Be aware of any deadlines for claiming tax credits or rebates.

- DIY Installation: Tax credits often require professional installation by a licensed HVAC contractor. Verify this requirement before starting the project.

Conclusion

Upgrading to a more efficient central air conditioning system is an investment that can pay off in the long run through lower energy bills, improved comfort, and potential tax savings. By understanding the available tax credits and rebates, choosing an energy-efficient system, and properly maintaining your equipment, you can maximize your savings and enjoy a more comfortable home for years to come. Consult with a qualified HVAC contractor and tax professional to ensure that you're taking full advantage of all available incentives.